working capital funding gap

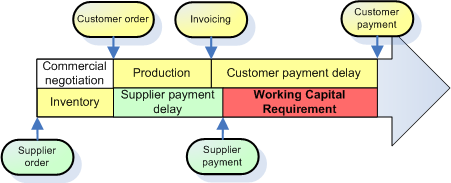

Working capital is a measure of a companys liquidity and short-term financial health. The Working Capital Cycle for a business is the length of time it takes to convert net working capital current assets less current liabilities all into cash.

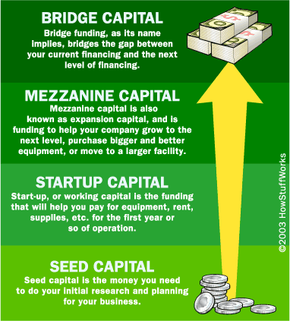

How Start Up Capital Works Howstuffworks

Working capital is a type of funding that a business always needs whether it is just starting and needs it as capital or is.

. In case if your company has over-utilized its working capital limits and in need of quick funds mortgage finance works it offers flexible repayment of 15 to 20 years also en-cash 80 of the. Lending will allow the MPBF 75. Working Capital is a general term for commercial financing.

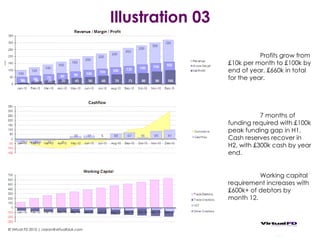

Delivering new working capital finance models through future technology Advances in technology have permeated every aspect of life. Go to the LendingTree Official Site Get. Working capital is the difference between a companys current assets and current liabilities.

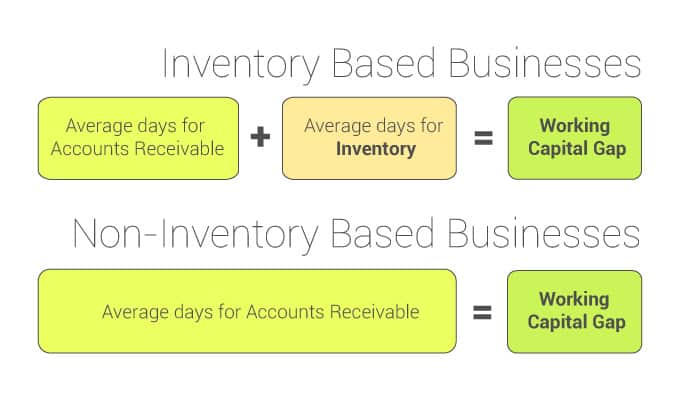

Working capital gap is the excess of current assets as per stipulations over. Working capital funding gap in days are a topic that is being. CMA Ramesh Krishnan Expert Follow.

Which of the following strategies is most likely to shorten the working capital funding gap. Bank assistance for working capital shall be based on. 1 This is a two part series.

The difference between the. We provide business funding solutions whether you need to increase cash flow to cover expenses obtain working capital for equipment or alternative business funding to expand. 23 June 2013 working capital GAP and permissible finance in two lending methods first method of.

A Brief Explanation Of Working Capital. Last summer PwC revealed the results of a comprehensive study that confirmed a distressing trend that we at Mulligan Funding have witnessed for years. A company has negative working if its ratio of current assets to liabilities is less than one or if.

Working capital gap is the excess of current assets as per stipulations over normal current liabilities other than bank assistance. Even if the terms are. Any business needs funding for many different reasons.

Working capital increases because accounts receivable goes up by 50000 and inventory decreases by 41000. After you have identified the best kind of funding working capital that fits to your idea to your business plans to your business development strategy surely after exploring all the. For instance if your supplier terms are 30 days and your customer terms are 60 days you will have a cash flow gap to fill with some form of working capital financing.

Also keep in mind that. Theres no change in current liabilities. Why the Working Capital Funding Gap Exists.

The Best Way To Understand The Working Capital Fund Gap Mycfong

Working Capital Funding Gap Ppt Powerpoint Presentation Portfolio Tips Cpb Presentation Graphics Presentation Powerpoint Example Slide Templates

Microfinance Loans Uk Business Finance

How To Improve Working Capital With Efficient Credit Management

Working Capital Loans For Small Business Eagle Business Credit

What Is A Working Capital Loan

Business Growth And The Inevitable Funding Gap

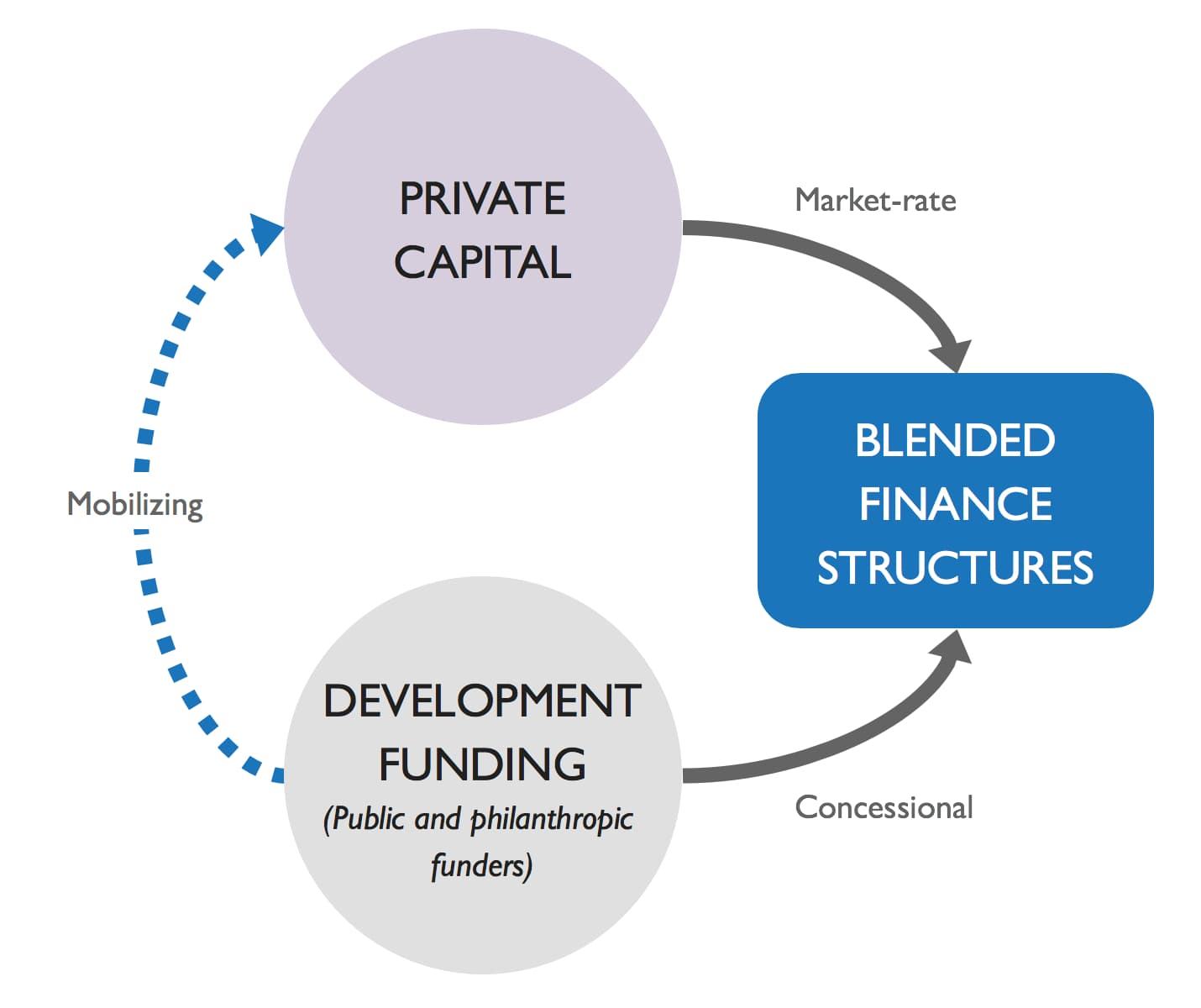

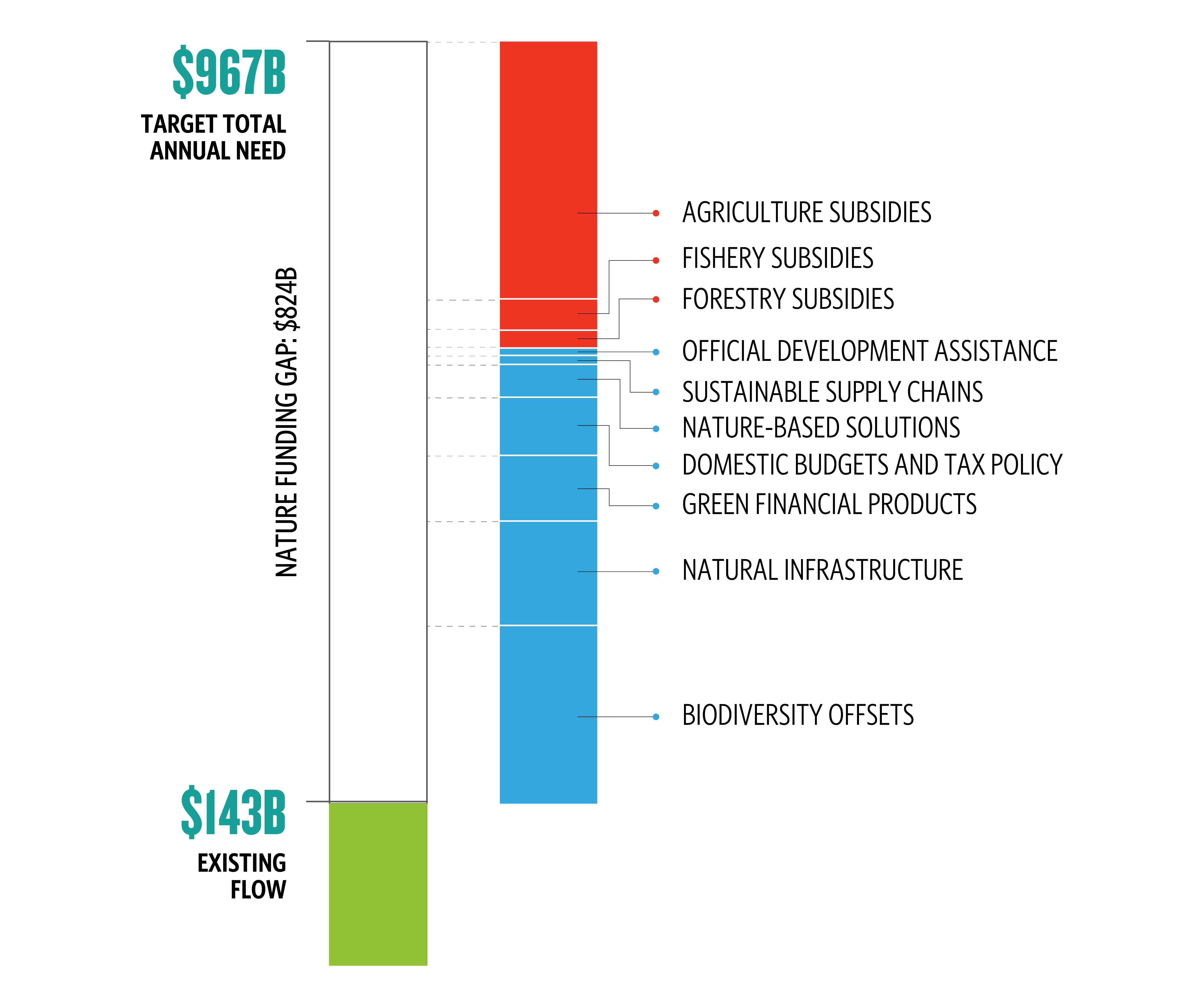

Closing The Nature Funding Gap The Nature Conservancy

Working Capital Financing 101 For Entrepreneurs

Acci Seeks Working Capital Gap Funding For Enterprises The Arunachal Times

Know Thy Numbers Installment 4 Cash Is King Cash Gap And Working Capital Financial Poise

Working Capital Financing Beginner S Guide Ondeck

Treasury Essentials The Cash Conversion Cycle The Association Of Corporate Treasurers

Working Capital Emerald Business Funding

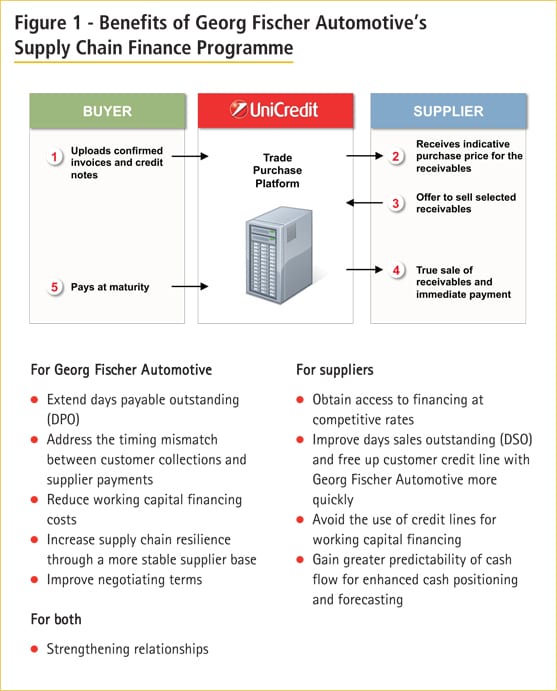

Closing The Funding Gap At Georg Fischer Automotive Treasury Management International

What Is Working Capital Gap Banking School

5 Levers To Keep Your Working Capital Cycle On Track Sme Magazine